While sales may be the most important activity in any business, it needs to be balanced with proper credit control procedures.

After all, selling to anyone and everyone without proper credit control could result in negative cash flow.

In taking on a new customer, there are several criteria that need to be evaluated before offering them credit on sales, and arriving at a credit limit.

Most systems offer a standard credit limit for each customer, but there is also the need to check if the customer’s account is overdue even though they may be well within the credit limit set for them.

Sage 300 Accounts Receivable offers both criteria for checking a customer’s credit worthiness.

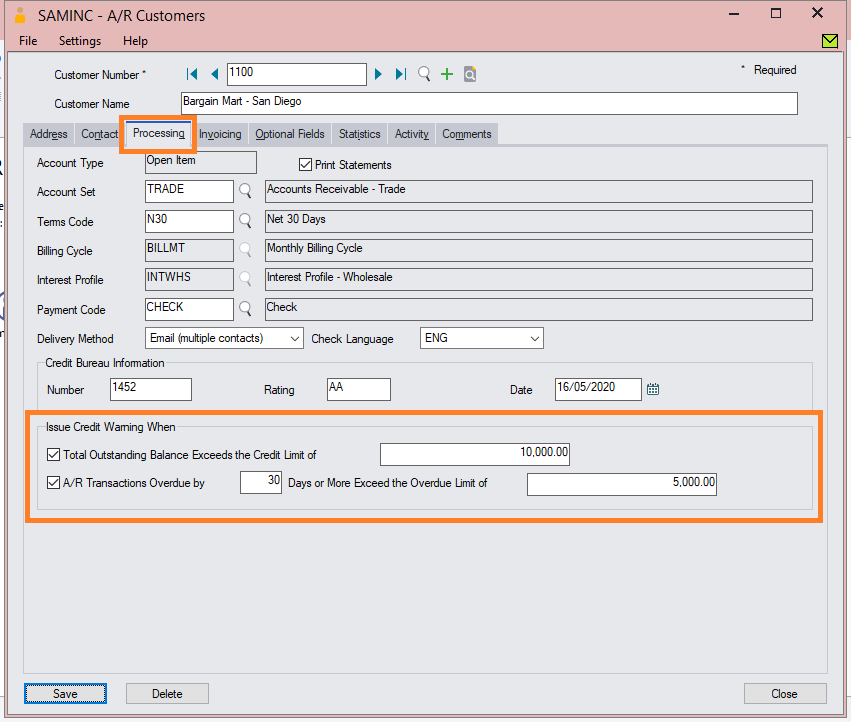

The first is of course the credit limit.

The second is where Accounts Receivable transactions are overdue by a given number of days and exceeds a given value.

You can also maintain credit bureau information about the customer.

These settings can be found at A/R Customers, Customers, on the processing tab of the customer record.

When issuing an invoice, If a customer exceeds assigned the credit limit and/or the customer’s unpaid transactions exceeds the number of days, you will receive a warning.

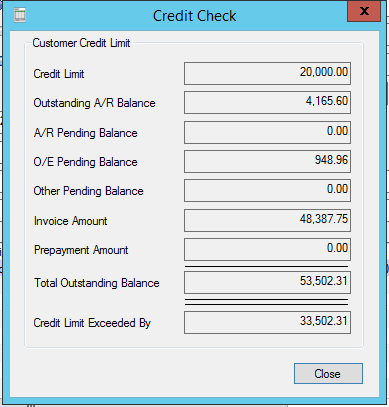

This screen shows:

- The credit limit assigned to this customer

- Outstanding A/R Balance

- Pending balances for:

- Account Receivable

- Order Entry, as well as,

- Balances from other modules, including third party

- The current invoice amount

- Total outstanding balance if the current invoice is issued, and,

- The amount that will exceed the credit limit.

Pending balances are from transactions that have not been posted to Accounts Receivable yet.

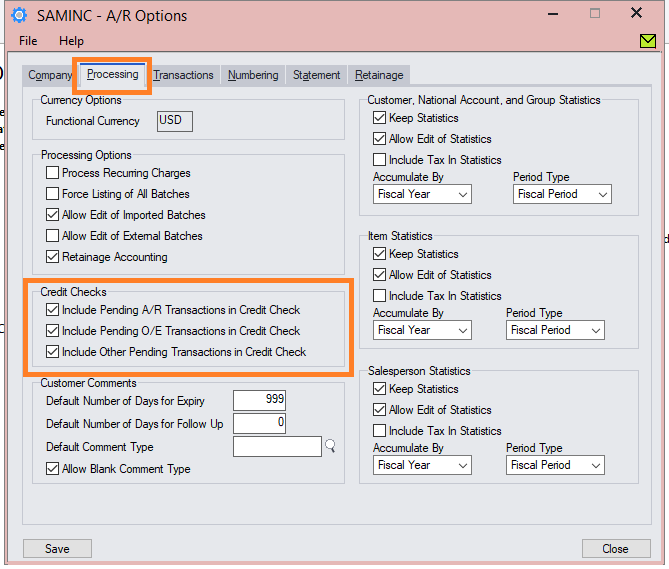

Setting up credit control

To setup these checks, you can turn them on by going to A/R Setup, then Options.

In the processing tab, check those settings that you prefer.